Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking

Peggy Malone

Peggy B Malone Ins Agcy Inc

Office Hours

Address

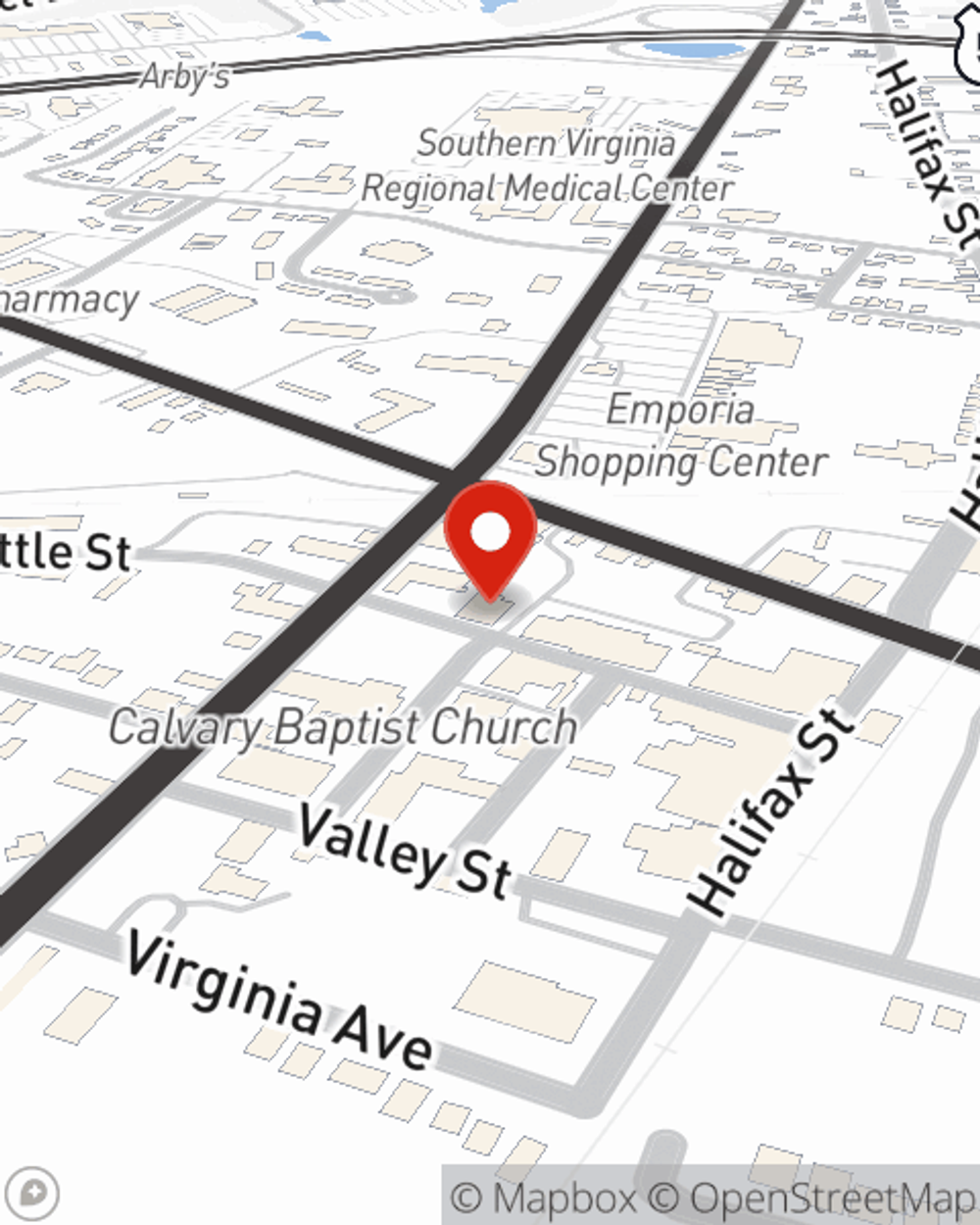

Emporia, VA 23847-1703

Emporia Police Station

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

-

Phone

(434) 634-3413 (434) 634-3296 -

Fax

(434) 634-3575

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking

Office Info

Office Info

Office Hours

-

Phone

(434) 634-3413 (434) 634-3296 -

Fax

(434) 634-3575

Languages

Simple Insights®

Is online banking safe? Yes — but there are some best practices

Is online banking safe? Yes — but there are some best practices

Tips for safe and secure online and internet banking.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

When should you start spending retirement savings?

When should you start spending retirement savings?

The age to start withdrawing from retirement accounts varies from person to person. What guidelines can you use to know when to start spending?

Viewing team member 1 of 2

Tara Malone-Menendez

License #595357

Tara has been with the Malone Insurance Agency since 1994, 34 years.

Tara serves as my Senior Account Manager and is able to assist customers with all their insurance needs. Tara is licensed in all lines of insurance, property/casualty and life/health. Tara can also assist customers with bonds and all types of commercial insurance.

Tara can help you with any of your insurance needs, from billing to policy changes to handling all claims and advising each customer of the all the coverages available to them.

Tara specializes in all we offer at the Malone Insurance agency.

Tara has one daughter and has been married for 24 years.

Tara serves on the board of the Emporia Greensville Humane Society and is a real estate agent in her spare time.

Stop by my office to see Tara as she will be happy to review your coverages and see if we can help you with all your insurance needs.

Viewing team member 2 of 2

Peggy Bailey